Support Fellowship for Performing Arts

Fellowship for Performing Arts, 630 Ninth Ave, Ste 1409, New York, NY 10036, USA

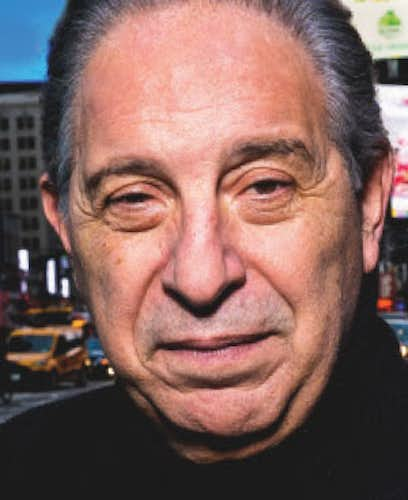

A Message From Max McLean

Fellowship for Performing Arts produces theatre, film and online events from a Christian worldview designed to engage a diverse, worldwide audience.

Fellowship for Performing Arts produces theatre, film and online events from a Christian worldview designed to engage a diverse, worldwide audience.

We pursue that mission with the help of people like you. That is why we are called Fellowship for Performing Arts. We are a fellowship of people who believe art from a Christian perspective can capture the moral imagination and influence culture.

This is an exciting time of opportunity. I invite you to help us make the most of it by donating through this page. Questions? Please contact us at [email protected].

Our first film – The Most Reluctant Convert: The Untold Story of C.S. Lewis – released in 2021 and became an international hit and continues to draw a global audience. It is available now on Amazon, Apple TV and Google Play.

And as we have launched a new theatrical piece and are working on our second and third films, you have never been more important.

Frequently Asked Questions

Yes, gifts to FPA are tax deductible to the fullest extent of the law. FPA will send you a tax-deductible receipt. FPA’s tax ID number is 52-1739276. We will happily send you our 501(c)(3) determination letter. You can request it by email at [email protected].

Yes! FPA receives matching gifts from many companies. Please ask your employer’s HR department if they will match your gift to FPA.

Yes. FPA receives gifts of stock via wire transfer through our account at Vanguard. Should you wish to make a gift of stock, please email us at [email protected].

Yes! Donations through estates, trusts and charitable gift annuities—among other options—all are available to FPA supporters. For more information email us at [email protected]

The Fellowship Circle is FPA’s primary support family. Over 90% of our donations come through Fellowship Circle members! We depend on this support. You can become a member by making gifts that total $1,000 or more within a single calendar year. We will acknowledge your gift by printing your name in our Playbill.

Yes. FPA finances are audited annually by an independent accounting firm and presented for review to the Board of Directors. Also, FPA has been a member in good standing of ECFA since 1996.

FPA receives nearly half its funding through ticket sales and depends on gifts from individuals, foundations and matching gift companies to achieve our mission of presenting theatre and film from a Christian worldview that engages a diverse audience.

Fellowship for Performing Arts’ statement of faith is summarized in the Nicene Creed. We are governed by a Board of Directors committed to the tenets of the creed and dedicated to sharing the Gospel through film and theatre from a Christian worldview meant to engage intellectually and spiritually diverse audiences.

Florida Registration Number: CH37403

A copy of the official registration and financial information may be obtained from the division of consumer services by calling toll-free within the state. Registration does not imply endorsement, approval, or recommendation by the state.

1-800-HELP-FLA (435-7352)

www.FloridaConsumerHelp.com